Unincorporated joint ventures in South Africa – What you need to know

05 Nov 2018

B-BBEE Requirements and Status

All entities wishing to obtain a B-BBEE certificate are measured against some or all of the pillars under the Codes. The Codes measure compliance of verified entities in respect of five pillars, namely:

- Ownership;

- Management and Control;

- Skills Development;

- Enterprise & Supplier Development, whose sub-pillars are Enterprise Development, Supplier Development and Preferential Procurement; and

- Social-economic Development.

Due to changes to the B-BBEE Codes (Codes), which gave ownership a greater weighting, many companies’ scores have gone down in terms of their most recent assessments.

Preferential Procurement and Customers

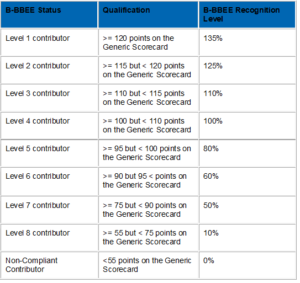

In order to increase their preferential procurement points, Customers, be it in the public or private sector, are increasingly stipulating a prerequisite for suppliers to have a Level 3/4 B-BBEE rating or better. In the private sector, the Level 3 rating enables customers to increase their preferential procurement points in line with the B-BBEE recognition level provisions of the Codes, which are detailed in the table below. For example, the Codes allow customers to claim ZAR1.10 as preferential procurement spend for every ZAR1.00 spent with a Level 3 B-BBEE rated company.

On the other hand, company’s Level 4 rating only enables its customers to claim ZAR1.00 per ZAR1.00 spent with company as preferential procurement spend.

Unincorporated Joint Venture Arrangements

While one option for companies is to establish special purpose vehicles (incorporated joint ventures), unincorporated joint venture (UJV) arrangements are an (easier) alternative available to companies due to their limited administrative obligations, the less onerous unwinding process, and their inclusion in and acceptance under the provisions of some (most) government tenders and the B-BBEE codes.

The UJV can be specific to certain customers and/or opportunities/contracts and/or industries, or general arrangements between the parties for all viable opportunities. As the UJV is an association of participants (or partnership), it does not have a formal legal structure and the participants do not have equity (shares) in the UJV.

The participants are bound and regulated by the terms of the contract between them and the commercial activities that they agree to pursue under the UJV. As such, undoing the UJV structure will be governed by the UJV agreement, and will be less onerous than unwinding an incorporated joint venture, which is governed by the provisions of the Companies’ Act and has certain statutory obligations. In short, the UJV ceases to exist at the expiration of the specific contract for which it was intended.

A UJV will typically enter into contracts but will not directly hire employees. Each UJV member will have its own tax liabilities. The contractual activities and obligations of the unincorporated joint venture will be handled by the members and will be governed by contract law. Resources and services can be ‘subcontracted’ to the UJV by the other participants.

A UJV is required to have its own consolidated B-BBEE certificate; with the UJV’s B-BBEE status being determined by combining the scores of each entity that is party to the agreement according to the UJV revenue / control split.

For this to work, each unincorporated joint venture participating company must have a valid B-BBEE certificate.

Administration and Management of the UJV

Although easier to manage and with less statutory requirements, unincorporated joint ventures will still require regular meetings between the participants, financials, management representatives, bank accounts, etc. The UJV will need to be managed in line with the provisions of B-BBEE legislation and customer requirements. This is particularly so as customers may have a legal right to assess the UJV’s compliance with legislation and the contract between themselves and the UJV i.e. customer’s right to audit the unincorporated joint venture.

In light of the above, careful consideration needs to be given to the establishment of each UJV i.e. the company should only enter into a UJV in special circumstances, where the size and profitability of the opportunity warrants same.

It is advisable that unincorporated joint ventures be established only in respect of sizeable opportunities, with a meaningful services component and with multi-year contracts attached to them.

In order to properly manage the UJV, the parties should:

- establish a steering committee with specific responsibilities, authorities and powers.

- assign a commercial/contract manager to ensure the UJV is managed in line with the provisions of the UJV agreement i.e. allocation of work, profitability etc.

- establish an authority matrix to ensure that decisions are taken at the correct authority levels.

As the UJV is not a legal entity, it will not have dedicated employees and each UJV participant will continue to employ its own employees separately, which employees can be deployed to provide services to the customer as per the agreed work allocation, the contract between the parties and the contract with the customer. Special consideration will need to be given to Section 197 transfers in respect of outsource arrangements, with the employees being correctly allocated based on the allocation of work.

“Shareholding” /Split (‘ownership’) vs control

The UJV participants will need to ensure that the structure, ‘ownership’ and control arrangements are compliant with the provisions of their UJV agreement, the customer’s requirements and what has been committed by the UJV participants to the customer as well as the provisions of B-BBEE legislation.

Billing and Bank accounts

The managing member of the UJV will contract with and invoice the customer, in the name of the UJV or its own name.

Either the managing member will have the bank account, or a joint account can be opened, giving both (or all participants) control over the account.

Assumption of risk

Although this can be regulated between the parties, as between the UJV and the customer, the participants will be jointly and severally liable towards the customer. The parties will need to separately agree to an equitable split of the penalties (i.e. allocate them to the party that is responsible).

Insurance, Tax and Accounting

Each participant will have to have its own insurance in line with the customer requirements.

Each participant will be responsible for its own tax compliance.

Appropriate measures will need to be taken to ensure the proper accounting treatment of unincorporated joint ventures in line with established accounting policies and processes.

See also:

- Further proposed changes to the generic B-BBEE Codes

- Knowing your B-BBEE reporting requirements

- Expanded legal content now available to navigate Africa’s business terrain