The SA RAF Fuel Levy: Insights for claimants and legal professionals

24 Apr 2024

The Road Accident Fund (RAF) Fuel Levy is a critical element of South Africa’s approach to supporting victims of road accidents. Acting as a financial backbone for the RAF, this levy is embedded in the cost of petrol and diesel, ensuring a continual flow of funds to assist those impacted by road incidents.

This article aims to demystify the RAF Fuel Levy, providing clarity and guidance for both legal professionals and claimants. Understanding the levy’s workings, its historical evolution, and its impact on the claims process is crucial for anyone involved in or affected by road accident claims.

Through this exploration, we hope to offer valuable insights into navigating the intricacies of this essential financial mechanism.

Understanding the RAF Fuel Levy

Basics explained

What is the RAF Fuel Levy?

The Road Accident Fund (RAF) Fuel Levy is an integral component of South Africa’s road accident compensation system. It represents a charge added to every litre of petrol and diesel sold in the country. The funds collected from this levy are allocated to the Road Accident Fund, which provides compensation to victims of road accidents.

How is it calculated and collected?

The levy amount is determined by the National Treasury and is reviewed annually as part of the government budget. This rate per litre is then integrated into the fuel price and collected at the point of sale. The collection process is overseen by the South African Revenue Service (SARS), which ensures the proper transfer of these funds to the Road Accident Fund.

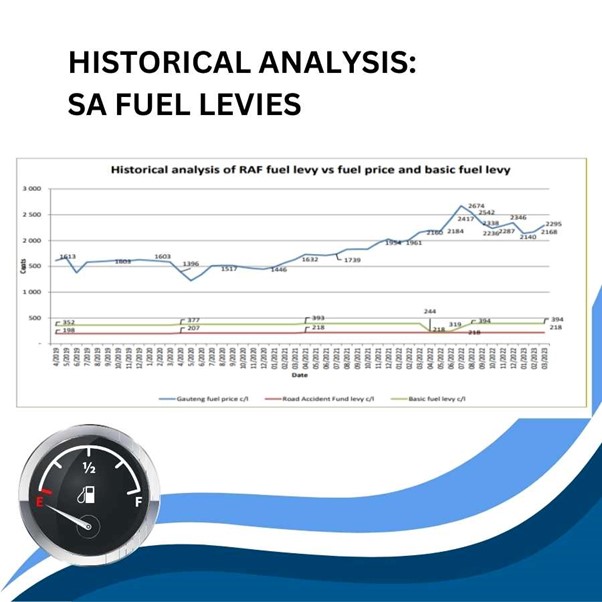

Source: Road Accident Fund Annual Statements; RAF Cash

Historical perspective

Brief history and evolution of the RAF Fuel Levy

The RAF Fuel Levy’s roots can be traced back to the early 20th century. Initially, road accident compensation was managed through compulsory motor vehicle insurance. However, due to sustainability challenges with this insurance model, South Africa shifted to a fuel levy-based system in 1986.

This transition was designed to provide a more stable and equitable source of funding for road accident victims, ensuring that the financial support is readily available regardless of individual insurance coverages.

Over the years, the levy has undergone several adjustments in response to the changing economic landscape, evolving into its current form as a cornerstone of the nation’s approach to road safety and victim compensation.

The role of the RAF Fuel Levy in Road Accident Claims

Impact on claimants

The RAF Fuel Levy is more than just a financial mechanism; it’s a lifeline for those affected by road accidents in South Africa. By contributing to the Road Accident Fund, this levy ensures that victims of road accidents have access to necessary financial support.

This support can cover medical expenses, loss of income, and compensation for pain and suffering. The real-life implications for claimants and their families are profound, offering a sense of security and relief in the aftermath of often traumatic experiences.

Legal practitioners’ perspective

For attorneys, understanding the RAF Fuel Levy is crucial in advocating for their clients’ best interests. Knowledge of the fund’s mechanisms aids in navigating claim processes efficiently and effectively.

Lawyers play a key role in guiding claimants through the complexities of RAF claims, ensuring that the compensation received is fair and in line with the damages incurred. A thorough grasp of the RAF system, including the fuel levy, allows legal practitioners to provide informed advice and robust representation for those they serve.

Challenges and operational insights

Financial constraints

The RAF Fuel Levy, while a crucial source of funding, faces significant financial challenges. These include balancing the need for adequate fund accumulation against the impact of levy increases on fuel prices and the broader economy.

The fund must manage these resources efficiently to meet the growing demand for claims, which often outstrips available finances. Understanding these fiscal limitations is essential for both claimants and legal practitioners, as it can influence the timing and amount of compensation.

Legal implications

Legally, the RAF Fuel Levy presents a set of unique challenges. Attorneys navigating claims against the RAF must be aware of the legal framework governing the levy and its application. This includes staying informed about legislative changes, court decisions impacting the fund’s operation, and the intricacies of claim procedures.

Common legal hurdles involve disputes over claim amounts, the interpretation of the fund’s obligations, and procedural complexities in filing and arguing claims. Legal professionals must be adept at overcoming these obstacles to effectively represent their clients.

RAF Fuel Levy in the context of global trends

Comparative analysis

A global perspective reveals various models similar to South Africa’s RAF Fuel Levy. Countries like the United Kingdom have the Motor Insurers’ Bureau funded by insurance companies, offering compensation for victims of uninsured drivers. The United States employs a decentralised approach, with mandatory car insurance differing across states.

Closer to home, Botswana and Namibia require mandatory third-party insurance. Each system reflects its unique socio-economic landscape, offering lessons on balancing inclusivity, financial stability, and administrative efficiency.

EVs and sustainability

Looking ahead, the rise of electric vehicles (EVs) presents a significant shift. EVs’ increasing popularity, aligning with global environmental goals, could reduce petrol and diesel sales, impacting the RAF Fuel Levy’s revenue.

This scenario necessitates exploring alternative funding mechanisms for the RAF, such as adapting the levy to include EV-related charges or integrating it with vehicle license fees. The RAF’s future success hinges on balancing sustainable transportation trends with maintaining a vital social security system in a changing environmental landscape.

Practical advice for claimants and their families

Navigating the claims process

When making a claim with the RAF, it’s important to follow certain steps and considerations:

- Documentation: Ensure all necessary documents, such as medical reports and police statements, are collected.

- Timelines: Be aware of deadlines for filing claims to avoid any lapses.

- Understanding your rights: Familiarise yourself with what the RAF covers, such as medical expenses and loss of income.

Seeking legal assistance

Choosing the right attorney for RAF claims is crucial:

- Specialisation: Look for lawyers who specialise in RAF claims, as they’ll have a deeper understanding of the process.

- Track record: Consider their success rate with similar cases.

- Communication: Choose someone who communicates clearly and keeps you informed throughout the process.

Conclusion

Navigating the complexities of the RAF Fuel Levy is essential for both claimants and legal practitioners. This article aimed to shed light on its workings, providing clarity and guidance. Understanding the levy’s impact, its challenges, and global trends helps prepare for effective navigation through the claims process.

With informed knowledge, claimants and their families can make educated decisions, and legal professionals can offer more comprehensive assistance. Stay informed and prepared.

See also:

- The Road Accident Fund Act 56 of 1996: A guide for legal professionals and claimants

- Accidental death and road accidents

- Should RAF be imposing a requirement on foreign nationals to produce stamped passports after finalisation of the matter?

- The general principles of the Road Accident Fund